Closing Entries: Step by Step Guide

You should recall from your previous material that retained earnings are the earnings retained by the company over time—not cash flow but earnings. Now that we have closed the temporary accounts, let’s review what the post-closing ledger (T-accounts) looks like for Printing Plus. Temporary (nominal) accounts are accounts thatare closed at the end of each accounting period, and include incomestatement, dividends, and income summary accounts.

Stay up to date on the latest accounting tips and training

- The Philippines Center for Entrepreneurship and the government of the Philippines hold regular seminars going over this cycle with small business owners.

- This givesyou the balance to compare to the income statement, and allows youto double check that all income statement accounts are closed andhave correct amounts.

- In a sole proprietorship, a drawing account is maintained to record all withdrawals made by the owner.

- Are the value of your assets andliabilities now zero because of the start of a new year?

It is also important to note that the income summary account is primarily used in the manual accounting process. If your business uses automatic software to manage your financial needs, it will not use an income summary account to shift these temporary account balances. The process of closing entries in accounting ensures the temporary accounts have a balance of zero at the end of the period. The funds must be transferred into another account, the income summary account, to bring each account balance down to zero.

Why You Can Trust Finance Strategists

As you will see later, Income Summary is eventually closed to capital. Prepare the closing entries for Frasker Corp. using the adjustedtrial balance provided. Notice that the Income Summary account is now zero and is readyfor use in the next period.

Wrap up Your Accounting Period With Closing Entries

Let’s move on to learn about how to record closing those temporary accounts. Manually creating your closing entries can be a tiresome and time-consuming process. And unless you’re extremely knowledgeable in how the accounting cycle net present value vs internal rate of return works, it’s likely you’ll make a few accounting errors along the way. Now, it’s time to close the income summary to the retained earnings (since we’re dealing with a company, not a small business or sole proprietorship).

What is an income summary account?

By leveraging automated systems, businesses can ensure that all tasks related to closing entries are handled seamlessly, reducing manual effort and minimizing errors. Once we have made the adjusting entries for the entire accounting year, we have obtained the adjusted trial balance, which reflects an accurate and fair view of the bakery’s financial position. The trial balance is like a snapshot of your business’s financial health at a specific moment. It lists the current balances in all your general ledger accounts. In this case, we can see the snapshot of the opening trial balance below.

The Accounting Cycle

The income summary account is only used in closing process accounting. Basically, the income summary account is the amount of your revenues minus expenses. You will close the income summary account after you transfer the amount into the retained earnings account, which is a permanent account. Closing entries are a necessary part of the accounting cycle as they allow businesses to generate financial statements and file tax returns every month and year accurately. It is important to note that previous accounting period data should not be carried over into a new period, as it can greatly skew information and negatively impact businesses.

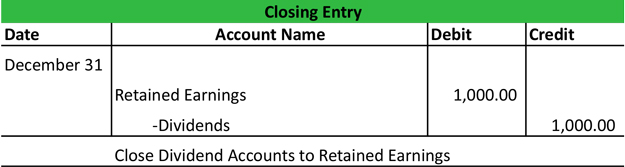

The income summary account is a temporary account solely for posting entries during the closing process. It is a holding account for revenues and expenses before they are transferred to the retained earnings account. Closing your accounting books consists of making closing entries to transfer temporary account balances into the business’ permanent accounts. Although it is not an income statement account, the dividend account is also a temporary account and needs a closing journal entry to zero the balance for the next accounting period. Transferring funds from temporary to permanent accounts also updates your small business retained earnings account.

By leveraging advanced workflow management, the no-code platform, LiveCube ensures that all closing tasks are completed on time and accurately, reducing the manual effort and the risk of errors. Organizations can achieve a 40% increase in close productivity, resulting in a more streamlined financial close process and allowing your team to focus on more strategic activities. The third entry requires Income Summary to close to the Retained Earnings account. To get a zero balance in the Income Summary account, there are guidelines to consider. An accounting year-end which is not the calendar year end is sometimes referred to as a fiscal year end. The Income Summary balance is ultimately closed to the capital account.